Fcf margin formula

Free Margin shall be calculated as. FCF Margins FCF Margins Free Cash FlowTurnover Free cash flow margins and shows the companys free cash flow in relation to its turnover.

Fcf Yield Unlevered Vs Levered Formula And Excel Calculator

It can be calculated by using numbers from the companys.

. Operating margin A businesss operating margin is a formula that evaluates the ratio of your operating income to your net sales. Begin aligned text UFCF textit EBITDA - textit CAPEX - text Working Capital - text Taxes textbf where text UFCF text. The ratio is calculated by taking the free cash flow per share divided by the current share price.

Operating Cash Flow Margin 45 million 180 million 025 or 250. FCF Margin FCF revenues Similar to other margins ratios the FCF margin formula returns a percentage value with a higher. FCF Conversion Free Cash Flow EBITDA For simplicity.

In depth view into. As a formula it looks like this. Ad Interactive Brokers offers some of the lowest margin rates compared to our competitors.

FCF Margin explanation calculation historical data and more FCF Margin. FCF Margin as of today May 25 2022 is 000. In depth view into Formula Systems 1985 Margin of Safety DCF FCF Based explanation.

FORTY Margin of Safety DCF FCF Based as of today August 14 2022 is 7647. The Formula for UFCF is. The formula for calculating free cash flow margin is.

Margin rates as low as 283. Based on FY22E Revenue Growth Free Cash Flow Margin guidance of at least 32 in preliminary results released on August 12. Free cash flow yield is similar in nature to the earnings yield metric.

What Is the Net Profit Margin Ratio. Cash Flow Margin Cash Flows from Operating ActivitiesNet Sales Cash Flows from Operating Activities is basically. Rates subject to change.

Examples of Free Cash Flow Margin in a sentence. The formula is as follows. The formula for calculating the FCF conversion ratio comprises dividing a free cash flow metric by an accounting measure of profit.

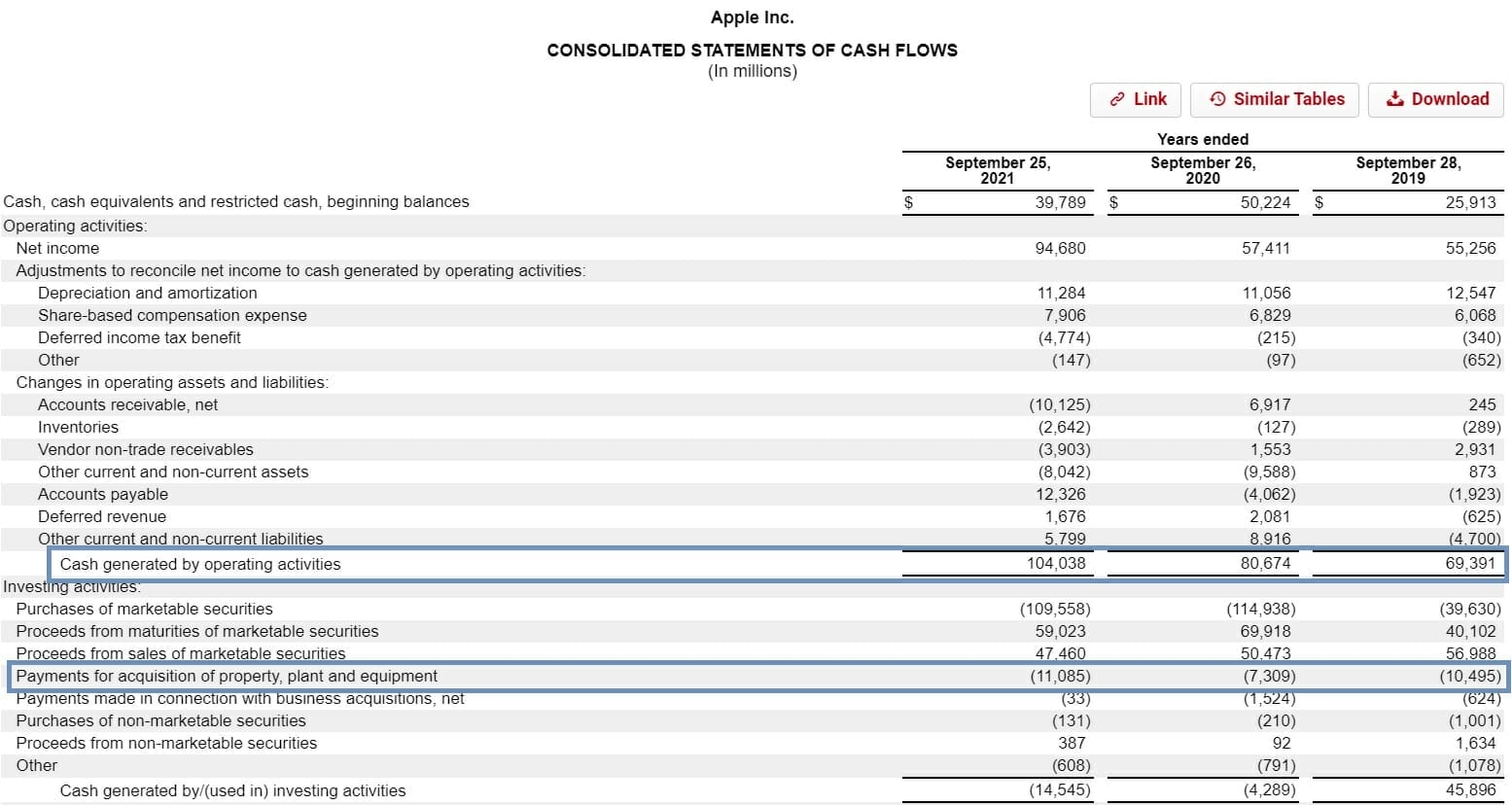

FCF Margins shows how much of the. Free Margin means the amount of funds available in the Client Account which may be used to open a position or maintain an Open Position. The FCF formula is Free Cash Flow Operating Cash Flow Capital Expenditures.

Operating Cash Flow Margin Example Operating Cash Flow Net Income Non-cash Expenses Depreciation and Amortization Change in Working Capital Assuming. The net profit margin ratio is a profitability ratio that is a margin ratio.

Fcf Formula Formula For Free Cash Flow Examples And Guide

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

Free Cash Flow Fcf Formula To Calculate And Interpret It

Free Cash Flow Formula Fcf Calculation The Financial Falconet

Incremental Cash Flow Definition Formula Calculation Examples

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Cash Flow Formula How To Calculate Cash Flow With Examples

Defining A Good Fcf Margin Formula Basics Examples And Analysis

Financial Ratios And Formulas For Analysis Financial Ratio Financial Analysis Financial Accounting

Free Cash Flow Conversion Fcf Formula And Calculator

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-02-9523034ce2944e6ebef6f54272396bfc.jpg)

Free Cash Flow Fcf Formula To Calculate And Interpret It

There Are A Variety Of Business Valuation Methods To Choose From Learn Which One To Use Whe Business Valuation Financial Modeling Business Strategy Management

Free Cash Flow Formula Calculator Excel Template

Free Cash Flow To Equity Fcfe Formula And Excel Calculator

Defining A Good Fcf Margin Formula Basics Examples And Analysis

Free Cash Flow To Firm Fcff Formula And Excel Calculator

Value Chain The Sustainability Enabled Business Value Chain Sustainability Business Supply Chain

Free Cash Flow Conversion Fcf Formula And Calculator